car lease tax california

Calculating the taxes on your lease is easy. Making the distinction between a true lease or sale at the outset is crucial because for sales the tax must be.

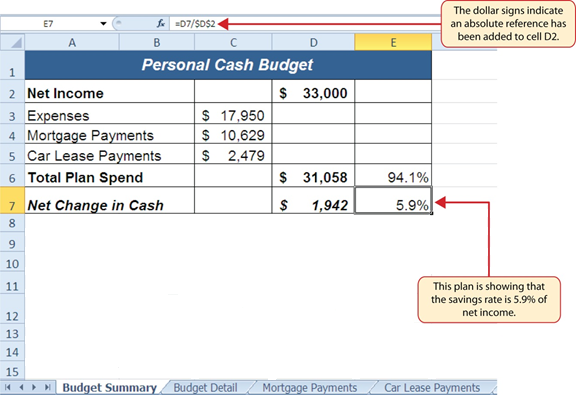

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Car leases offer a short-term flexible way of having a car without having to be burdened with it as your own depreciating asset for many years ahead.

. The sales tax also includes a 50 emissions testing fee. Beginning January 1 2021 certain used vehicle dealers are required to pay the applicable sales tax on their retail sales of vehicles directly to the Department of Motor Vehicles. Love the car so far.

I chose to lease a MY. You can choose leases that fit with a. On June 29 2020 California passed Assembly Bill AB 85 Stats.

If you dont buy the vehicle at the end of the lease you may have to pay a disposition fee to return the vehicle. The acquisition fee will range from a few hundred dollars to as much a 1000 for a higher-end luxury car. When you lease a car you may pay a small monthly use tax on the lease depending on your state or local tax rate.

If you go over the miles allowed you will be charged for the extra miles at the end of the. For vehicles that are being rented or leased see see taxation of leases and rentals. The California State Board of Equalization Board has promulgated Regulation 1660 which explains the law as it applies to leased property in general and transactions that may look like leases but are actually outright sales.

8010 Completing the Report of Sale-Used Vehicle REG 51 8015 Corrections on the Report of Sale-Used Vehicle REG 51. California collects a 75 state sales tax rate on the purchase of all vehicles of which 125 is allocated to county governments. Section 2987 of the California Civil Code is the Moscone Vehicle Leasing Act.

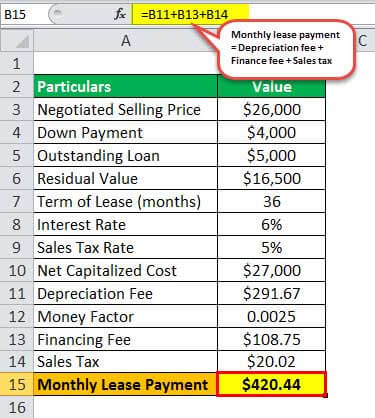

However lessees can charge them reasonable fees for. The California vehicle tax is 75 percent but this simple number only gives you a rough idea of what youll really pay for a new car. For example if a lease on a Mercedes-Benz E-Class has a monthly price of 699 before tax and your sales tax rate is 6 the monthly lease tax is 4194 in addition to the 699 base payment.

The local government cities and districts collect up to 25. Acquisition Fee Bank Fee. Leases limit the number of miles you may drive the vehicle often 12000 to 15000 miles per year.

Sales tax in California varies by location but the statewide vehicle tax is 725. Since the lease buyout is a purchase you must pay your states sales tax rate on the car. A car lease acquisition cost is a fee charged by the lessor to set up the lease.

The last time I checked sales tax in CA for auto is 725. When you purchase a car you pay sales tax on the total price of the vehicle. This makes the total lease payment 74094.

Multiply the base monthly payment by your local tax rate. As evidence of a leases tax exempt status lessors must furnish lessees with either a resale or exemption certificate. This means you only pay tax on the part of the car you lease not the entire value of the car.

The bank or leasing company may not charge or collect the tax on the sale of the leased vehicle ie the lease buyout amount. Things to consider before leasing. Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease pay-off.

Under the California Code vehicle lessees have a legal right to terminate their vehicle lease agreements before the scheduled date of expiration. Local governments such as districts and cities can collect additional taxes on the sale. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure.

8 and AB 82 Stats. On a lease you pay sales tax monthly not up front - so just take your base payment lets say 350 a month- and multiply that payment by the sales tax in your state i am in washington and the sales tax in the area i am in is 98 3430- and my monthly lease payment is 38430 KABOOM. The act governs transactions between vehicle lessors and lessees.

From a multistate tax planning perspective one of the most important points to know is that leased property located outside of California is considered tax exempt. Calculate Tax Over Lease Term. I emailed Tesla Financial about it and the response I received was that the sales tax is 925 to explain the total amount.

As of September 2011 Oregon Alaska New Hampshire Montana. If your taxes will be rolled into the monthly payments divide this by the number of months you will hold the lease to find how much you will pay in taxes each monthAug 5 2019. The most common method is to tax monthly lease payments at the local sales tax rate.

Reasons Car Leasing is Popular in California. So on the 1948 sales tax that you mentioned about 155 to 180 of that is due to the 2000 decrease that you alluded to. On the other hand if an out-of-state lessor leases tangible personal property that will be physically located within the state of.

How Much Is the Car Sales Tax in California. In California the tax on a lease is levied on the monthly payment and any ceiling reduction. I just received my first monthly lease bill and it was a little higher than originally stated.

Sells the vehicle within 10 days use tax is due only from the third. 8005 Collection of California Sales Tax. The year 2020 showed everyone that everything in life can turn on a dime with a single event.

How to Calculate California Sales Tax on a Car. For example if you previously paid 1500 sales or use tax to another state for the purchase of the vehicle and the California use tax due is 2000 the balance of use tax due to California would be 500. As with any other sales tax you simply multiply your state tax rate by the sum of your monthly payments.

Revisit the dealership that sells the vehicle you wish to lease. Its sometimes called a bank fee lease inception fee or administrative charge. This page covers the most important aspects of Californias sales tax with respects to vehicle purchases.

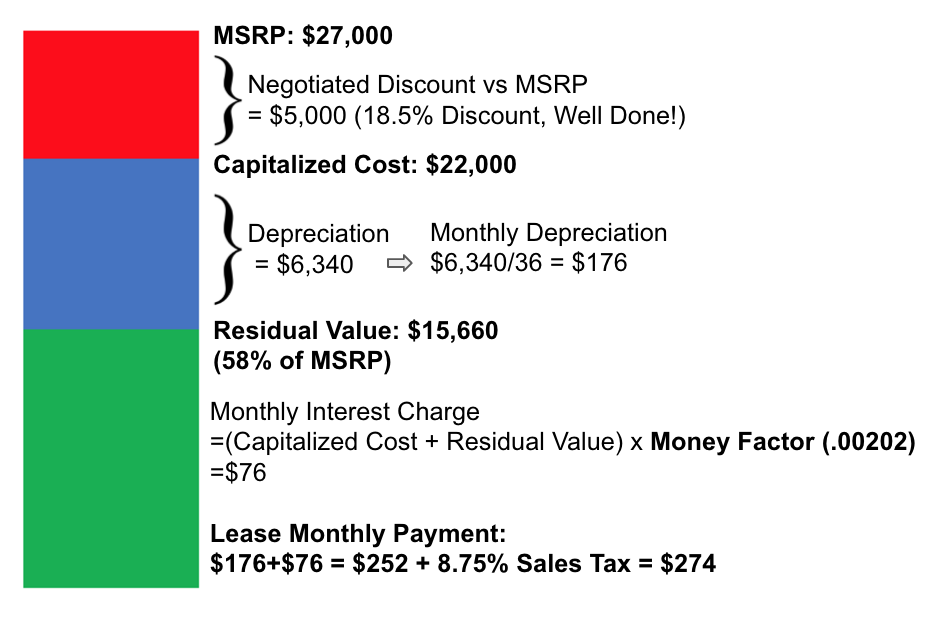

Negotiate a sales price for the vehicle with the car salesman aiming for the lowest price possible starting from the wholesale car priceKeep sales taxes in mind as California sales taxes can raise the final cost of the car significantly ranging from 725 percent in areas like Ventura or Yuba counties to as high as 975. Of the 725 125 goes to the county government. The states overall sales taxes vary by location which can.

Is It Better To Buy Or Lease A Car Taxact Blog

Car Tax By State Usa Manual Car Sales Tax Calculator

Why Car Leasing Is Popular In California

Why Car Leasing Is Popular In California

4 Ways To Calculate A Lease Payment Wikihow

Lease Payment Formula Example Calculate Monthly Lease Payment

/is-a-high-mileage-lease-right-for-me-527161_FINAL-a6fc1fa14dd246cd93c63cf8d96bd931.png)

Is A High Mileage Lease Right For Me

Leasing A Car Consumer Business

Lease Payment Formula Explained By Leaseguide Com

How To Negotiate Your Next Car Lease Like A Pro

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

2 3 Functions For Personal Finance Beginning Excel First Edition

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Car Tax By State Usa Manual Car Sales Tax Calculator

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

How Does Leasing A Car Work Earnest

Leasing Fees Explained In Detail Everything You Need To Know Capital Motor Cars

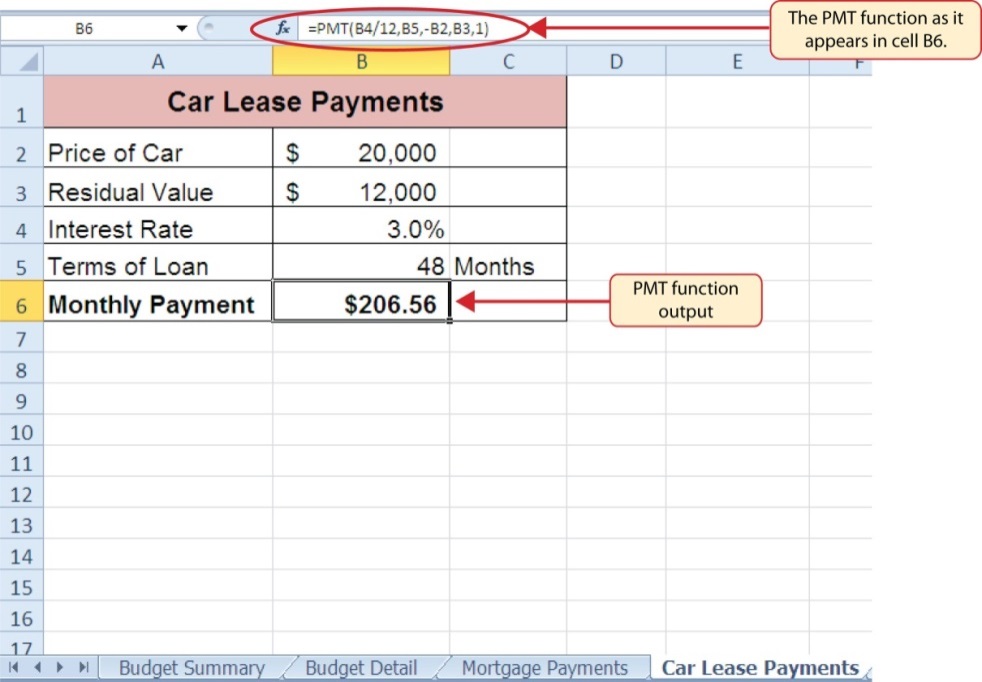

9 2 The Pmt Payment Function For Leases Excel For Decision Making