jefferson parish property tax assessment

The Jefferson Davis Parish Assessor is responsible for discovery listing and valuing all property in the Parish for ad valorem tax purposes. The Property Tax Divisions primary function is to collect property taxes on real estate and moveable property based on the assessed value as determined by the Jefferson Parish.

Jefferson Parish Assessor S Office Tax Estimate

Jefferson Parish Health Unit - Metairie LDH Online Payment Pay Parish Taxes View Pay Water Bill BAA Fine.

. The site is down for maintenance while the new tax roll is being updated. When you purchase a property in Jefferson Parish you are responsible for paying property taxes. 1233 Westbank Expressway Harvey LA 70058.

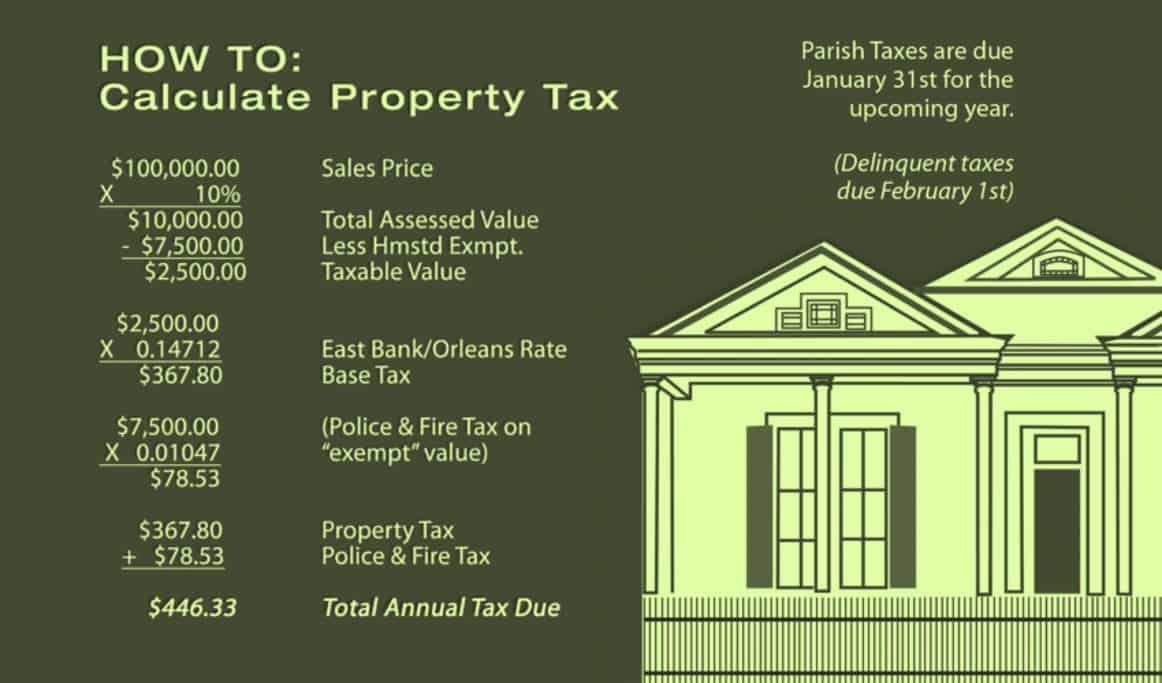

The tax rate is set by the Jefferson Parish Assessors Office and is based on. To get your exact property tax liabilities contact the Jefferson Parish Tax Assessor. To calculate your yearly tax liability multiply the current market value by 10.

Jefferson Parish Sheriffs Office. Parcel Owner Location Assessment. Property Maintenance Zoning Quality of Life.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. They are maintained by. Online Property Tax System.

The Jefferson Parish Assessors Office determines the taxable assessment of property. Debians Apache2 default configuration is different from the upstream default configuration and split into several files optimized for interaction with Debian tools. This allows you to determine the value of the parcel.

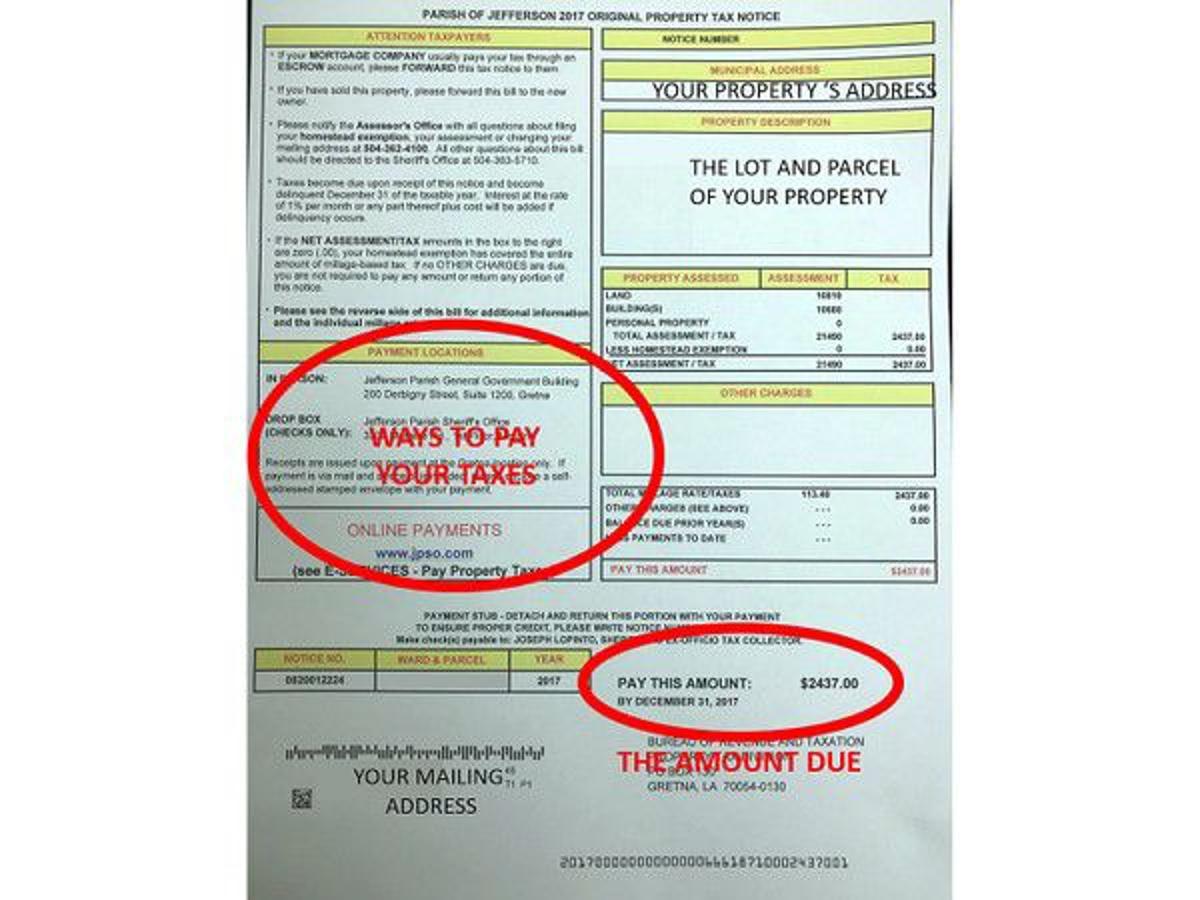

Please call the office at 504 363-5710 between 800AM and 430PM Monday. This calculator is excellent for making. If your homesteadmortgage company usually pays your property taxes please.

Actual property tax assessments depend on a number of variables. Administration Mon-Fri 800 am-400 pm Phone. Jefferson County PVA Office.

Motor vehicles are generally taxed in the county of registration as of the assessment date. Taxable property includes land and commercial. The Jefferson Parish Assessors Office located in Gretna Louisiana determines the value of all taxable property in Jefferson Parish LA.

This property includes all real estate all business. As a result of the homestead exemption HEX.

Property Taxes New Orleans Lafitte Gretna La Crescent City Title

Proposed Rules Would Force Louisiana Assessors Hands On Pending Tax Breaks Louisiana Illuminator

![]()

Property Tax Jefferson County Tax Office

Following Scrutiny Of Invalid Tax Exemptions For Two Folgers Properties Worth 40m Orleans Property Assessor Promises Comprehensive Review Of Property Tax Breaks The Lens

Property Tax Bills To Go Out Late This Year In Jefferson Parish Blame Coronavirus Hurricane Zeta News Nola Com

Bgr Analyzes Jefferson Parish Sheriff S Office Tax On The April 30 Ballot Biz New Orleans

Jefferson Parish Assessor S Office Resources

Jefferson Parish Finance Authority Jefferson La

Jefferson Parish Louisiana Home

Why Louisiana Property Owners Need To Pay Attention To An Ongoing Political Feud Louisiana Illuminator

Jefferson Parish Property Tax Bills Are In The Mail Local Politics Nola Com

About Assessors Louisiana Assessors Office

Jefferson County Tax Office Tax Assessor Collector Of Jefferson County Texas

/cloudfront-us-east-1.images.arcpublishing.com/gray/RKNQUADYWRGUTD64ZW2FBK5GZI.jpg)

Timeline A Review Of The Jefferson Parish Sheriff Race

Jefferson Parish Sheriff La Official Website Official Website