tax abatement definition for dummies

Abatement is a reduction in the level of taxation faced by an individual or company. This burden might take the form of a debt an import tariff a tax a fine a penalty or a reduction of the percentage being charged like an interest rate or a tax bracket reduction.

For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would.

. Tax abatements typically take the form of a decrease in the amount of tax owing or a rebate being issued. Tax abatements are the most frequent scenarios where the term is employed and they. Post the Definition of tax abatement to Facebook Share the Definition of tax abatement on Twitter.

An abatement is usually requested by property owners who feel that the tax assessment is too high. The term commonly refers to tax incentives that attempt to promote investments that boost economic growth or provide other social benefits. The term abatement is also used in law to mean the removal or control of an annoyance.

Tax abatement on property is a major savings. By Devon Taylor. Tax abatements are reductions in the amount of taxes an individual or company is responsible for paying.

Tax increment financing TIF is a financial tool used by local governments to fund economic development. Low- to middle-income residents are usually the target demographic for these programs. At the end of the abatement period the person owing it becomes liable for paying taxes in full comparable to.

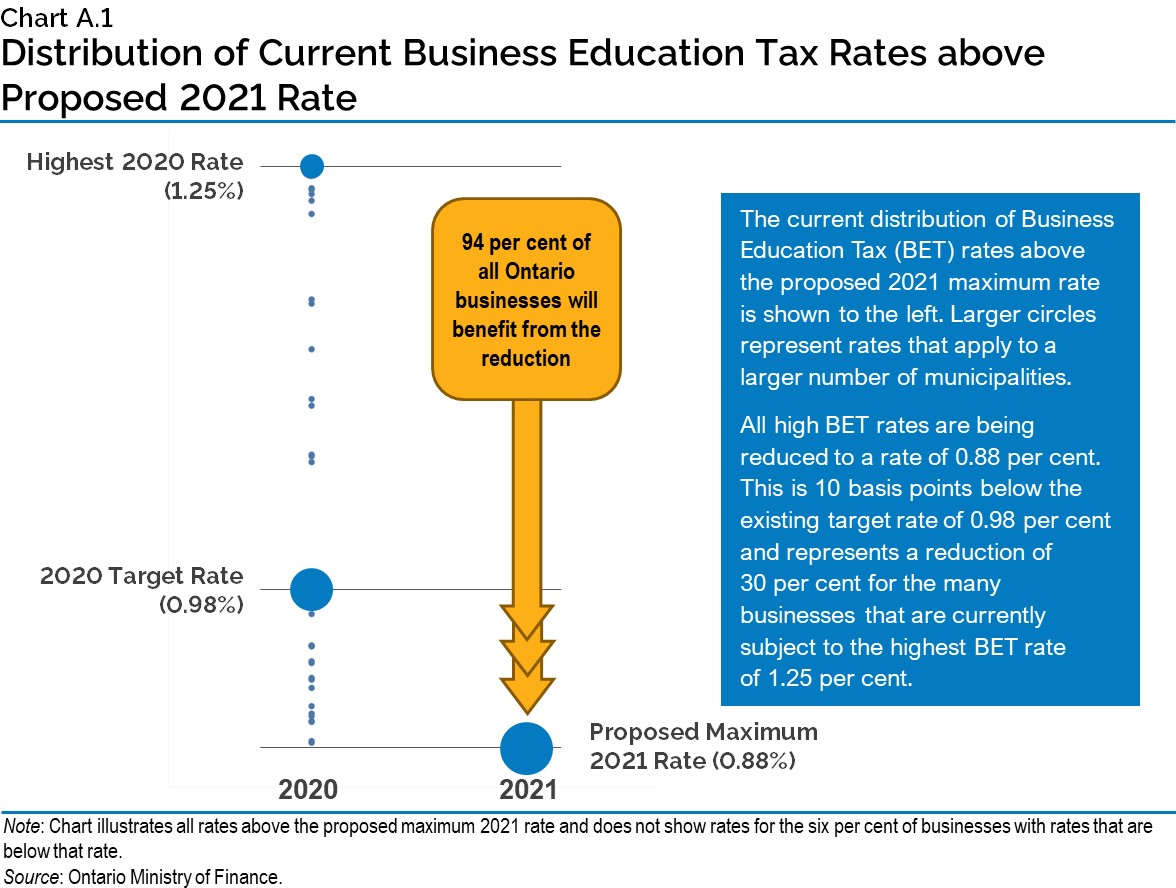

A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area. Most owners of houses will be required to pay property taxes that are commonly from 1 to 3 of the value of the house every year. The tax abatement is designed to make these areas more appealing to prospective buyers and developers.

When you get a tax abatement the government is essentially giving you a tax break on certain types of real estate property business. A tax abatement is a reduction in the amount of taxes a business or individual must pay to the federal state or municipal levels of government. Unless you speak IRS its really difficult to understand this Buttonow says.

Taxes are compulsory contributions to the state you live in and to the federal government levied by the government to pay for things that society as a whole needs but people cant pay for individually. The meaning of TAX ABATEMENT is an amount by which a tax is reduced. January 30 2014 Brigid DSouza.

Abatements can last anywhere from just a few months to multiple years at a time. A Property Tax Abatement is essentially an agreement by the city to charge the property owner less in property tax than the owner would otherwise pay without the abatement. Penalty abatement removal is available for certain penalties under certain circumstances.

A tax abatement is a financial incentive offered by a municipality or taxing authority that significantly reduces or eliminates the amount of taxes owed on a residential or commercial property. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax obligations due to circumstances beyond your control. What Does Abatement Mean In Legal Terms.

This makes sense because the legal definition of abatement is a reduction suspension or cessation of a charge. A sales tax holiday is another instance of tax abatement. Though the basic concept of TIF is straightforwardto allow local governments to finance development projects with the revenue generated by the developmentits implementation can differ in each state and city where it.

Tax-abatement as a means A temporary suspension of property taxation generally for a spe-cific period of time. For example a tax return is the document you file normally for income taxes and you might receive a tax refund if youve overpaid. That includes everything from the roads you drive on to law enforcement to the salary of the President of the United.

Tax abatement or a tax holiday means that a persons tax obligations are reduced by a certain amount. Mayor Fulop signed his abatement policy into effect by executive order on December 24 2013. Either way challenging a first-time penalty could have its own.

Dictionary Entries Near tax abatement. It represents part of the ongoing cost of owning a home. Although towns and cities typically.

In broad terms an abatement is any reduction of an individual or corporations tax liability. Property tax abatements are offered by some cities in the form of programs that reduce or eliminate property tax payments on qualifying property for a set amount of time to be determined on an individual case basis. For instance local governments may offer abatements to cover the cost of building new infrastructure to.

It also obligates these individuals to live or do business in the neighborhood in order to receive the full advantages that come with the tax abatement offer. Tax abatements are also designed to stimulate the local economy with the. Abatement in law the interruption of a legal proceeding upon the pleading by a defendant of a matter that prevents the plaintiff from going forward with the suit at that time or in that form.

In other words when your taxes are abated it means that your taxes are lowered. Its important to note some important terminology for the purpose of this article. Abatement of Debts and Legacies is a common law doctrine.

But its OK to get help from a tax pro. In most jurisdictions there are multiple programs that abate property taxes if a person or the property is eligible. A reduction of taxes for a certain period or in exchange for conducting a certain task.

The term abatement refers to a situation where an economic burden is reduced. This annual expense does not disappear when the mortgage is completely paid. See More Nearby Entries.

Property tax abatement is a decrease in the amount of money owed to a governmental tax authority on a real property tax bill. Examples of an abatement include a tax decrease a reduction in penalties or a rebate. Tax Abatements 101.

IRS Definition of IRS Penalty Abatement. More from HR Block. An amount by which a tax is reduced See the full definition.

If an individual or. Tax abatement is a temporary reduction of taxes but it could still last for years. Tax Abatement Meaning.

In some instances an abatement can also result in a reduction of penalties. The policy was a clear departure from his campaign pledge which included the promise to allocate abatement revenue to a dedicated non-discretionary account for education funding. Taxes in a nutshell.

Canadian Controlled Private Corp Canadian Tax Lawyer

West Midtown S Interlock Project Could Claim Another 5 4m In Tax Abatement Eco Architecture Urban Design Concept Urban Concept

Tax Policy And The Economy Vol 36

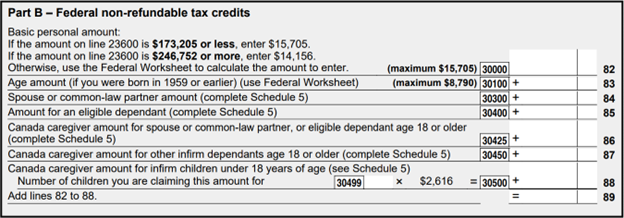

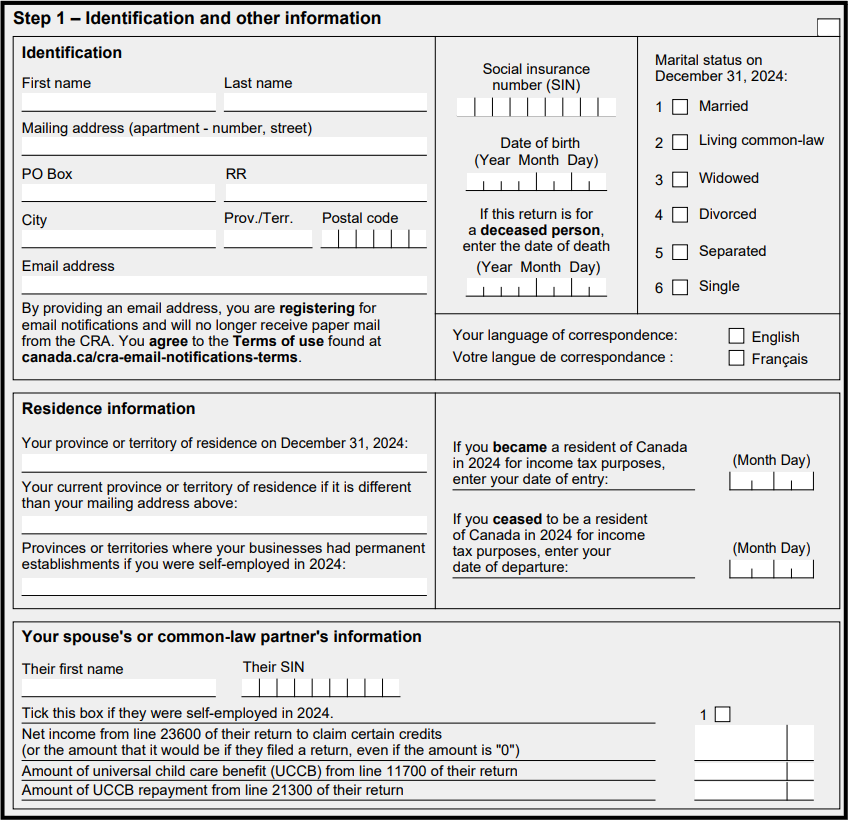

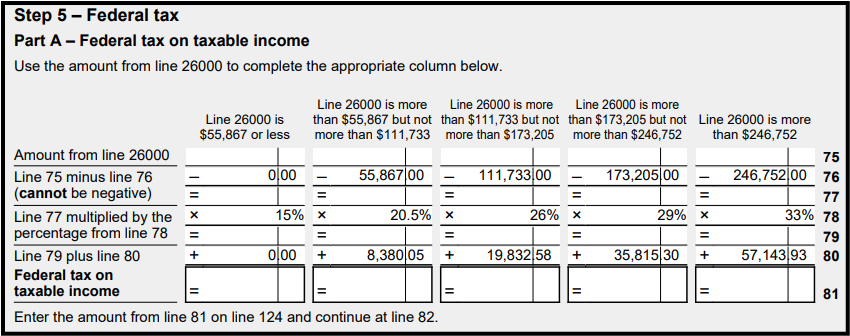

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

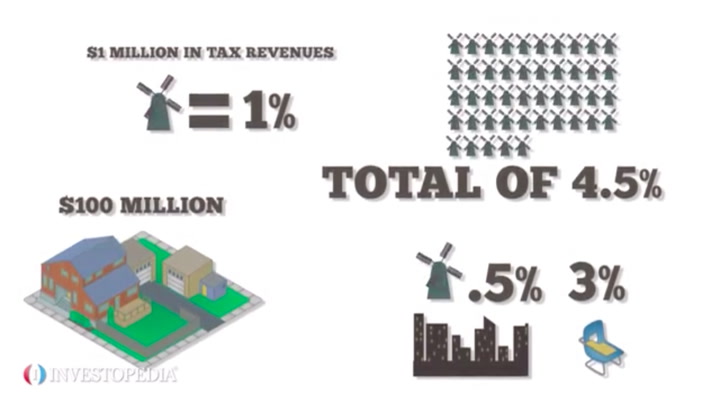

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

How Property Taxes Are Calculated

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Tax Abatements Alabama Department Of Revenue

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Taxes For Factoring In Negative Externalities Video Khan Academy

A Solar Powered Home Will It Pay Off Mortgage Lenders Paying Student Loans Top Mortgage Lenders

:max_bytes(150000):strip_icc()/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)